- 3 trades each day, risking $100 per single trade

- Targeting $200 per day trading session

- Monthly trading profits: $4,000–$5,000 (after slippage)

Day trading with $25,000 is a key turning point for retail traders aiming to go full-time. It unlocks advanced features, removes the Pattern Day Trader (PDT) limitations, and opens up real opportunities for compounding capital. But how much can you make day trading with 25k in actual conditions? The short answer is: it depends on your discipline, trading strategy, and risk control. Below, we break down the math, share expert insights, and present examples from real traders.

What Is Day Trading With $25K?

Day trading with $25K refers to operating a margin-enabled trading account with the minimum balance required to bypass PDT restrictions. This account balance allows unlimited day trades in U.S. stock markets and enables more flexible use of margin and diversification. Many traders use this threshold as a psychological and strategic milestone for serious intraday trading activity.

How Much Can You Make Day Trading With 25K?

Returns vary. But based on performance tiers observed in live brokerage accounts and proprietary broker firms, here’s a comparison:

| Risk Profile | Monthly Return | Annual Return |

|---|---|---|

| Conservative (1%/month) | $250/month | $3,000/year |

| Moderate (3%/month) | $750/month | $9,000/year |

| High (5–10%/month) | $1,250–$2,500/month | $15,000–$30,000/year |

Expert Insight: “Expecting more than 5% monthly return consistently is usually a red flag — either the trading strategy is overly aggressive or the risk controls are weak.” — Dr. Ethan Ross, Risk Manager at Bright Trading LLC

Top Strategies for Day Trading With $25K

Scalping

Short-duration trades designed to profit from tiny price moves. Suitable for highly liquid assets. Popular among experienced traders using Pocket Option’s quick trade interface.

Momentum Trading

Ride stocks or crypto assets experiencing high trading volume and strong directional momentum. Ideal during earnings season or news catalysts.

VWAP Reversal

A classic for futures trading and forex pairs — trade reversals near the volume-weighted average price within a single trading day.

Realistic Example of Day Trading With $25K

Trader Emma Lin uses $25K to day trade stocks like SPY and QQQ on a margin account. She applies a simple rule-based trading plan:

She began with paper trading and emphasized: “I spent six months simulating trades. Now, I make enough money consistently without exceeding my risk tolerance.”

The 25K Rule and PDT Status

Pattern day traders must maintain a $25K minimum in their margin account to avoid restrictions. You’re a pattern day trader if you execute four or more day trades within five business days. Many new traders ignore this, triggering trade holds in cash accounts or brokerage warnings.

Why Many Day Traders Lose Money

Statistically, many traders lose money due to lack of a solid trading plan, insufficient capital, or attempting to day trade with less than required. Day trading isn’t easy — it requires effort, a clear understanding of the ins and outs of day trading, and the ability to track every trade.

“Day trading success isn’t about making $500 a day right away. It’s about learning the requirement for day trading, minimizing much risk, and refining your approach every trading day.” — Miguel Duarte, Trading Coach

Risk Management When Trading With $25K

- Maximum risk per trade: 1% of account balance ($250 max)

- Daily loss cap: 3% to prevent trading with emotion

- Build your trading experience through paper trading and journaling

- Use stop-losses in every trade — successful day trading is about defense

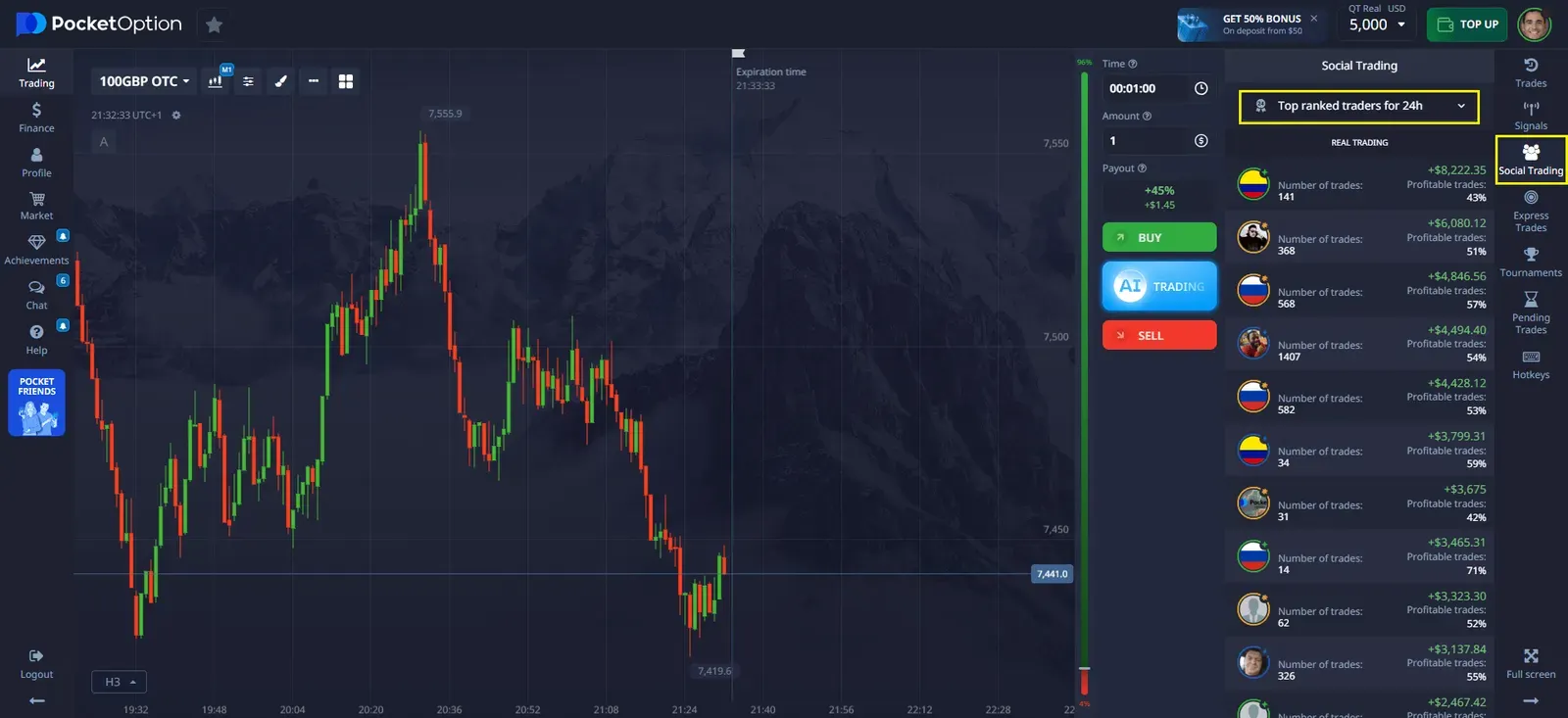

Pocket Option: Platform Built for Quick Trading

Pocket Option is a regulated broker offering access to forex, crypto, stocks, and commodities. On this platform, you can start trading with as little as $5 and access social trading, tournaments, demo accounts, and technical indicators. The platform supports up to 92% profitability per trade — meaning a $100 trade can yield $92 profit within minutes with a correct forecast.

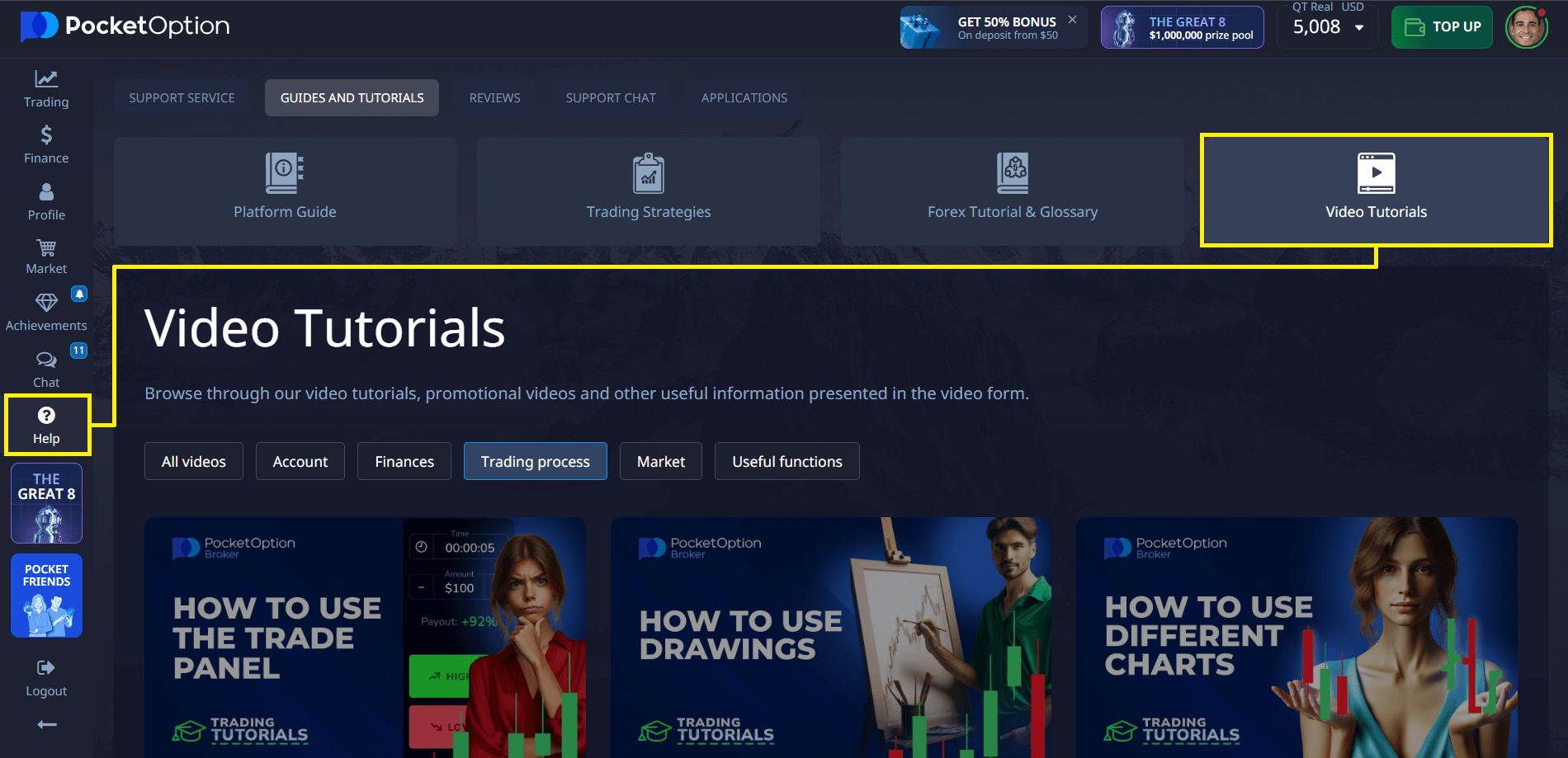

Use sentiment tools, copy trading, and chart indicators to build a consistent profit strategy. Start day trading with less capital and grow gradually. Want to learn the outs of day trading in practice? Explore the Help – Guides & Tutorials – Video section (available after registration) where many day traders share tips on how they started.

Real Trader Reviews

- Jonas R.: “Started with a small account and used the demo for weeks. Now I trade stocks and forex pairs daily.”

- Sofia M.: “I make trades using technical setups and sentiment filters — no guesswork.”

- Arman T.: “The broker’s fast execution really helps when you’re scalping five or more trades within five minutes.”

Key Takeaways for New Day Traders

- Many traders make mistakes by trading without a strategy or entering too many day trades as you want.

- Consider swing trading if trading with less than $25K.

- Understand the PDT rule and plan your total trades accordingly.

- Trading involves risk — never risk more than you can lose.

- The stock market offers opportunity, but trading is hazardous without preparation.

Conclusion

To start day trading successfully, you need capital, discipline, and knowledge. The $25K to day trade rule exists for a reason — it encourages new traders to approach the market professionally. Whether you’re trading for a living or learning to trade stocks part-time, following the rules and understanding trading volume, risk tolerance, and your trading capital will set you apart. Make as many day trades as your plan allows — but track every trade, review your performance weekly, and don’t underestimate how much money you can make by staying consistent. Discuss this and other topics in our community!

FAQ

Is $25,000 enough to make a living day trading?

While $25,000 meets the PDT rule requirement, making a full-time living typically requires larger capital. With exceptional skill, 10-15% monthly returns could generate $2,500-$3,750, but this level of consistency is uncommon for beginners.

What percentage return is realistic when day trading with $25k?

Experienced traders might achieve 5-15% monthly returns, though this varies widely. Beginners should expect lower returns or even losses while developing skills. Consistent 20%+ monthly returns are rare and unsustainable long-term.

How many trades per day should I make with a $25k account?

Quality matters more than quantity. Many successful traders make only 2-5 high-probability trades daily. Overtrading often leads to commission drag and emotional mistakes that reduce profitability.

Do I need to use all $25k for day trading?

No, using your entire capital on single positions significantly increases risk. Most professional traders use position sizing that risks only 1-2% of their account on any single trade.

How long does it take to become profitable day trading with $25k?

Most traders require 6-12 months of consistent practice to develop profitability. The learning curve involves developing pattern recognition, emotional discipline, and a personalized trading strategy that fits your personality.

Can you make $200 a day with day trading?

Yes, it is possible, but it requires experience, discipline, and a proper strategy. For example, traders on Reddit share their experiences: "You can start with $1000 and make $50–100 a day trading MES futures". However, it’s important to remember that such results are not guaranteed and depend on many factors, including market conditions and personal discipline.

How much can a day trader make with $1000?

The amount depends on various factors, including strategy, risk management, and market conditions. For example: With 1% risk per trade ($10) and a 2:1 risk-to-reward ratio, a trader might make around $20 per trade. To reach an average monthly salary ($1500), it would take about 75 profitable trades, which is quite extreme and unstable. Some experienced traders aim for daily profits of 1–3%, which on a $1000 account means $10–30 a day. Traders on the Kalshi platform, for example, make $150–165k through algorithmic trading in predictive markets .

What happens if you are flagged as a PDT but have over $25,000?

If your account is flagged as a PDT (Pattern Day Trader), you must maintain a minimum of $25,000 in your account to trade on margin. If your balance falls below this amount, you won’t be able to open new positions during the day, even if your account is back above $25,000 the next day. Keep your balance above $25,000. Use a cash account instead of a margin account. Limit day trades to 3 in 5 business days if the balance is below $25,000.