- BTC/USD = 68,000 means one Bitcoin equals 68,000 US dollars

- BTC is what you’re buying or selling

- USD is what you’re using to trade

Bitcoin Trading Essentials: From Understanding Fundamentals to Successful Trading Strategies

Bitcoin has transformed finance since 2009, becoming a premier digital asset for investors globally. Whether you're learning how to invest in Bitcoin long-term, how to trade Bitcoin for profits, or simply how to buy Bitcoin, this walkthrough provides essential information to start confidently.

What is Bitcoin?

Bitcoin is a decentralized digital currency created in 2009 by Satoshi Nakamoto. It enables peer-to-peer transactions without banks, with all activity recorded on the blockchain.

Unlike traditional currencies, Bitcoin operates without government control, maintained by a global network of miners.

Bitcoin functions as a payment method, investment vehicle, and trading asset. Its limited supply of 21 million coins makes it valuable for those wondering how to invest in Bitcoin as an inflation hedge.

How Currency Quoting Works (Simple Explanation)

Understanding quotes is essential before learning how to trade Bitcoin. Bitcoin is typically shown as BTC/USD.

In this format:

When the rate rises from 68,000 to 70,000, Bitcoin gains value against the dollar. A decrease indicates Bitcoin is losing value.

This knowledge is crucial for anyone learning how to buy Bitcoin at good rates.

Factors That Influence Bitcoin Price Movement

For successful Bitcoin trading, understand these key price factors:

Market Sentiment: News and social media impact price. Example: Tesla’s $1.5 billion Bitcoin investment in 2021 caused a 20% price surge.

Regulations: Government policies affect investor confidence. China’s 2021 mining ban led to a 50% price drop.

Supply and Demand: With only 21 million possible coins and 19 million already mined, scarcity drives value during high demand.

Institutional Adoption: Major companies accepting Bitcoin increases legitimacy and price.

Economic Factors: Inflation and currency instability increase Bitcoin demand as a value store.

Understanding these elements is vital for how to invest in Bitcoin strategically.

How to Read Bitcoin Price Movements

Interpreting Bitcoin price action is crucial for trading success:

Price Patterns: Bitcoin shows support/resistance levels and trends. The $60,000 level shifted from resistance to support between 2021-2023.

Timeframes: Choose based on your strategy:

- 1-hour: Day trading

- 4-hour/daily: Swing trading

- Weekly: Long-term investing

Volume: High-volume movements typically indicate stronger trends.

Market Structure: Higher highs suggest uptrends; lower lows signal downtrends. This understanding is essential when learning how to trade Bitcoin.

Indicators: Tools like RSI identify potential reversal points. RSI above 70 suggests overbought conditions; below 30 indicates oversold.

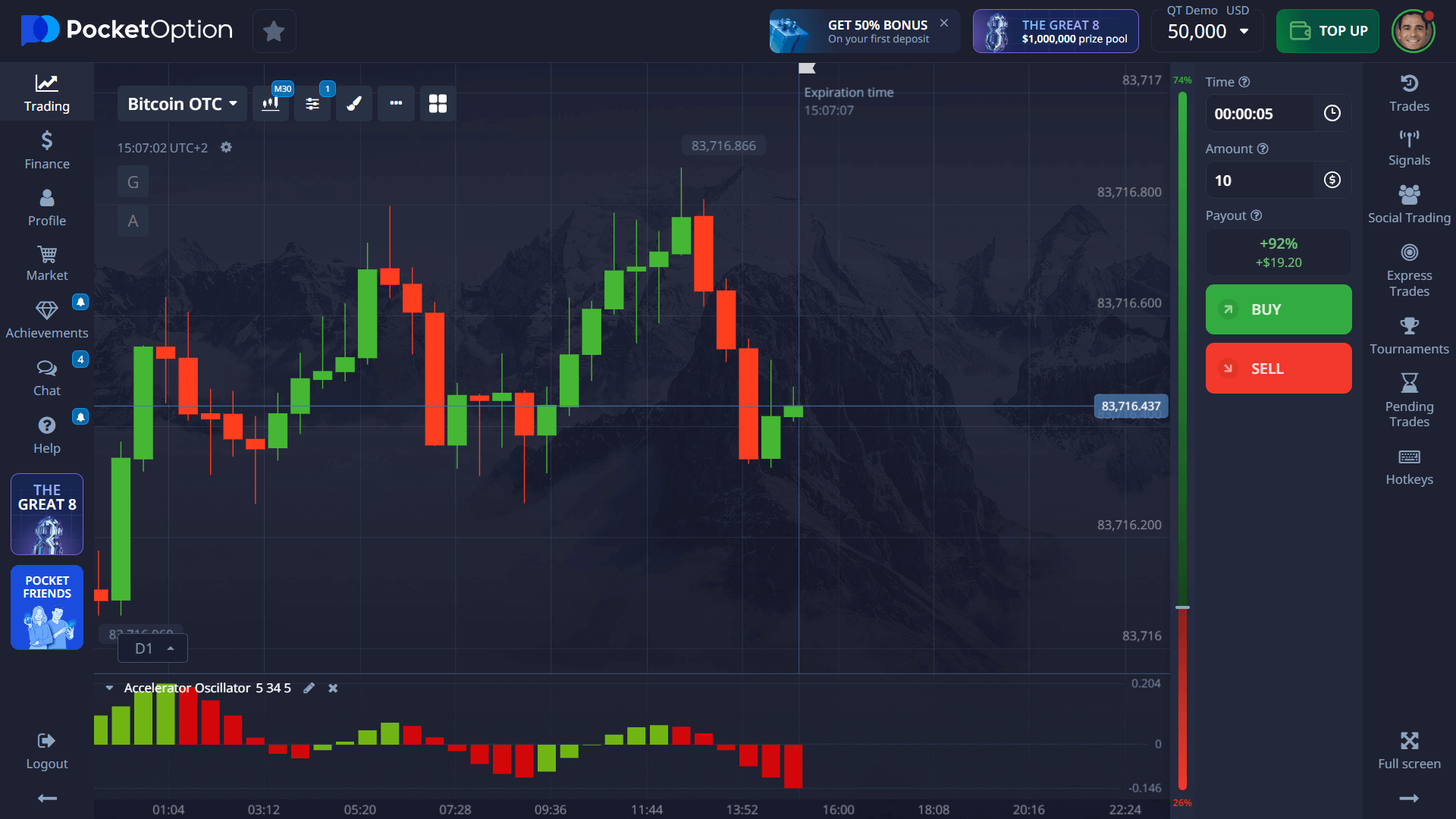

Step-by-Step: How to Trade Bitcoin on Pocket Option

For those exploring how to buy Bitcoin and trade effectively, follow these steps:

1. Select Bitcoin: Choose Bitcoin or Bitcoin OTC (available 24/7) from the asset list.

2. Analyze: Use Pocket Option’s tools:

- Moving averages for trend identification

- RSI for overbought/oversold conditions

- Volume indicators for confirmation

3. Set Amount: Start from $1, risking only 1-3% per trade.

4. Choose Timeframe: Select from 5 seconds to multiple days based on your strategy.

5. Predict Direction:

- Select “BUY” for expected rises

- Select “SELL” for anticipated drops

- View potential returns (up to 92%) before execution

6. Execute and Monitor: Confirm parameters and track your position.

Starting requires only registration and a $5 minimum deposit.

Risk-Free Bitcoin Trading: Master the Markets with $50,000 Demo Account

New to Bitcoin trading? Pocket Option offers a $50,000 demo account to:

- Practice without financial risk

- Test strategies across market conditions

- Master analysis tools

- Develop trading discipline

- Refine risk management

Use the demo to:

- Analyze historical price patterns

- Test news-price correlations

- Compare indicator effectiveness

- Experiment with position sizing

Once ready, transition to live trading with just $5 to access:

- Copy Trading with successful traders

- Cashback up to 10% of volume

- Trading tournaments with prizes

- Advanced charting tools

This risk-free approach is ideal for anyone learning how to invest in Bitcoin safely.

FAQ

How to buy Bitcoin with no experience?

Register on Pocket Option and use the $50,000 demo account first. This risk-free environment helps beginners practice buying and trading Bitcoin. Once comfortable, make a minimum $5 deposit to begin real trading, using the platform's educational resources designed for cryptocurrency newcomers.

How to invest in Bitcoin long-term?

For long-term Bitcoin investment: 1) Use Pocket Option to purchase Bitcoin and hold as a store of value, 2) Implement dollar-cost averaging by buying small amounts regularly, 3) Research Bitcoin halving cycles which historically precede major price increases, and 4) Secure significant investments with hardware wallets.

How to trade Bitcoin effectively?

Effective Bitcoin trading requires combining technical and fundamental analysis. Use Pocket Option's indicators to identify trends and reversal points. Start with small positions (1-3% of your account) to manage risk. Keep a trading journal, follow cryptocurrency news, and consider Copy Trading to mirror successful traders while developing your strategy.

How to buy Bitcoin without high fees?

Minimize fees on Pocket Option by selecting cost-efficient deposit methods like bank transfers or specific e-wallets. Take advantage of the platform's transparent fee structure with no hidden charges. For larger purchases, consider splitting them into optimal-sized transactions, and watch for promotional periods when fees may be reduced.

How to get Bitcoin quickly?

To quickly acquire Bitcoin on Pocket Option: 1) Complete the 5-minute registration process, 2) Verify your account with the expedited KYC procedure, 3) Deposit using instant payment methods like credit cards or select e-wallets, 4) Navigate to Bitcoin trading pairs, and 5) Execute your purchase at market rates. The entire process can take under 30 minutes.