- Signal providers: Experienced traders sharing their strategies

- Followers: Users replicating these trades

- Trading platforms: Interfaces like Pocket Option enabling signal execution

- Risk controls: Tools for setting capital exposure and trade limits

In the dynamic world of online trading, mastering copy trading signal tools can be the key to smarter, faster decisions. For traders seeking to enhance results without spending hours analyzing charts, copy trading signal services offer a clear advantage. In this article, we’ll explore how signal copy trading and copy and paste trading signals work, why forex trading copying signals are popular, and how platforms like Pocket Option help you tap into their full potential.

Understanding Copy Trading Signals

Copy trading signals are real-time notifications about trading opportunities — often generated by advanced algorithms or successful traders. These alerts can be auto-executed in your account or followed manually. For many, signal copy trading means gaining access to professional-level strategies with minimal effort.

How Signal Copy Trading Works

The copy trading ecosystem is built on the following roles:

Each time a signal provider opens a position, the same trade is mirrored in the follower’s account — adjusted to the user’s risk parameters. This automation makes copy trading signal usage convenient for all levels of traders.

Choosing the Right Platform

The first step in copy trading is selecting a reliable and user-friendly platform. Pocket Option is a strong choice, especially for newcomers, thanks to its intuitive interface, fast trade execution, and social trading features. Its unique approach to fast-paced trading through quick trades (similar to binary options) appeals to traders seeking simplicity and speed.

Pocket Option primarily supports Forex, cryptocurrencies, and a variety of assets via its trading platform. It also offers built-in crypto signals, which provide visual cues and indicators to guide trading decisions. Users can follow successful traders and copy their trades with just a few clicks.

Key features to consider when using Pocket Option:

- Supported Markets: Pocket Option offers access to currency pairs, cryptocurrencies, commodities, and company shares—all within the framework of quick, timed trades rather than traditional leveraged markets like Futures.

- Trader Analytics: Profiles display win rates, trading history, and rankings via the platform’s leaderboard system. While more simplified than traditional broker stats, this information still helps users choose who to copy.

- Demo Mode: The platform provides a free demo account loaded with virtual funds. This is ideal for learning how to navigate copy trading mechanics and test strategies risk-free.

- Quick Trade Functionality: A key differentiator, Pocket Option allows trades based on very short timeframes (30s, 60s, 5min), providing a more dynamic and reactive environment for traders seeking fast results.

- Community Features: Tournaments, achievements, and chat functions allow users to engage with the broader trading community, learn from peers, and track real-time trading trends.

While Pocket Option may not suit those seeking detailed portfolio management or advanced order types, it’s a highly accessible platform for copy trading through a simplified and fast-paced trading model.

How to Copy a Trading Signal?

Copying a trading signal is a straightforward process, but it’s important to follow each step carefully to ensure that your investments align with your goals and risk tolerance. Here’s how to do it effectively:

- Register on a copy trading platform such as Binance, Bybit, or Pocket Option. These platforms provide access to thousands of professional traders and offer various tools for monitoring performance.

- Navigate to the “Copy Trading” or “Signals” section of the platform. This area contains curated lists of top-performing traders, active signals, and filtering options.

- Filter available traders and signals based on performance metrics like win rate, average return, risk score, number of followers, and trading style (e.g., Forex, Crypto, or Futures).

- Review each trader’s profile in detail. Look for transparent analytics, such as historical trade data, asset allocation, drawdown statistics, and verified trading history. Some platforms also offer community feedback and trust scores.

- Choose a trader to copy, but don’t just go for the highest returns. Evaluate how consistent their strategy is, how diversified their portfolio is, and whether they match your investment goals.

- Set your investment parameters. Most platforms allow you to configure trade size (based on percentage of your balance or fixed lots), set a maximum daily loss, apply a stop-copy trigger, and limit the number of open trades.

- Enable auto-copying. Once activated, your account will automatically replicate the chosen trader’s actions in real-time. You can pause or stop copying at any time, and you’ll still retain full control over your funds.

This process combines automation with flexibility, making it possible for even beginners to participate in the markets by leveraging the strategies of experienced traders.

Capital Allocation in Copy Trading: How to Do It Right

After choosing a trader to copy, the next crucial step is deciding how much capital you want to allocate. This should reflect your personal risk tolerance and investment goals.

Most copy trading platforms allow:

- Custom allocation per trader – Choose how much of your balance goes to each copied trader.

- Proportional trade mirroring – Automatically scale trades based on your allocated amount.

- Fixed trade limits – Set maximum amounts per trade or restrict the number of open positions.

📌 Tip:

- Allocate less to aggressive traders who use risky or short-term strategies.

- Allocate more to conservative traders with stable, long-term returns.

Example: With a $500 balance, you might assign $300 to a low-risk trader and $100 to a higher-risk one, keeping $100 as a reserve. This balanced approach spreads risk and increases flexibility.

Many platforms let you stop or adjust copying at any time, giving you full control despite automation.

📍 On Pocket Option, for instance, the setup window allows you to:

- Choose the investment amount

- Set available risk preferences

- Apply basic exposure limits like max capital per trade

While it doesn’t include tools like Stop Loss, it still offers essential controls to help manage your copy trading experience effectively.

Is Copy Trading Illegal?

Copy trading is legal in most countries but must comply with local financial regulations. Regulated brokers and platforms (e.g., under FCA, CySEC, ASIC) offer transparent and safe environments. Users should ensure that the platform is licensed and that the trader or signal provider is verified.

Some jurisdictions restrict copy trading for unlicensed brokers, so always check the platform’s compliance and regulatory status.

Which Copy Trading Is Best?

The best copy trading depends on your goals:

- For Crypto: Use Binance or Bybit for real-time access to high-volatility markets and integrated crypto signals.

- For Forex: Platforms like MetaTrader 4 or AvaTrade offer robust tools and precise execution.

- For Futures: Choose brokers with high leverage and advanced charting tools.

Look for platforms that offer low spreads, a wide range of assets, transparency in trader stats, and customizable copying settings.

What Is the Best Copy Trade Strategy?

There is no one-size-fits-all approach, but here are popular strategies:

- Trend-Following: Ideal for beginners, this strategy follows traders who identify long-term market trends.

- Scalping: Best for advanced users who follow traders making short-term, high-frequency trades.

- News-Based: Traders exploit market volatility during major news events.

- Diversified Approach: Copy several traders across different markets (Forex, Crypto, Futures) to reduce risk.

Evaluate strategies by drawdown rate, ROI consistency, and how they align with your risk tolerance.

How Copy Trading Strategies Work

Understanding the strategies used in copy trading is essential for any investor seeking to make informed decisions. While copy trading simplifies the process by automating trade replication, the effectiveness of your investment still largely depends on the underlying strategies employed by the traders you choose to follow. Here are some of the most common strategic approaches in copy trading:

Conservative Strategies

Conservative traders typically aim for stable, long-term gains with minimal risk. These strategies involve lower leverage, fewer trades, and a focus on established, less volatile markets like major currency pairs or blue-chip stocks. Conservative strategies are ideal for investors who prioritize capital preservation and gradual growth over high returns. These traders often utilize fundamental analysis and longer holding periods to minimize exposure to market fluctuations.

Aggressive Strategies

Aggressive strategies focus on maximizing short-term gains and are usually associated with higher risk. Traders using this approach may engage in scalping, high-frequency trading, or trade in highly volatile markets like cryptocurrencies. They often use high leverage and open many positions throughout the day. While this approach can generate significant profits, it also comes with the potential for large losses, making it more suitable for risk-tolerant investors.

Diversified Portfolio Strategy

One of the advantages of copy trading is the ability to follow multiple traders simultaneously. A diversified strategy involves allocating capital across several traders who use different approaches and operate in different markets, such as Forex, crypto, and stocks. This diversification helps spread risk and reduce reliance on the performance of any single trader. For example, losses in one market can potentially be offset by gains in another, resulting in a more balanced portfolio.

Data-Driven Strategy Selection

Most copy trading platforms provide key metrics about traders, including their historical performance, risk scores, drawdowns, and trading frequency. These metrics help investors assess whether a trader’s strategy aligns with their investment goals and risk tolerance. For instance, a trader with high returns but also high drawdowns might not be suitable for conservative investors. Instead, investors should look for consistency, long-term profitability, and a trading style that matches their expectations.

In summary, understanding and evaluating the strategies used by the traders you follow is critical to success in copy trading. Whether you prefer a cautious or aggressive approach—or a mix of both through diversification—the key is to continuously monitor performance and adapt your portfolio accordingly. Strategy awareness empowers investors to make smarter choices and optimize their outcomes in the dynamic world of copy trading.

Benefits of Copy and Paste Trading Signals

Here’s a breakdown of the key benefits of using copy and paste trading signals:

| Benefit | Description |

|---|---|

| Reduced screen time | No need to constantly watch charts |

| Faster learning curve | See how successful traders think and act |

| Lower entry barrier | No need for deep technical knowledge to start trading |

| Strategic diversification | Follow traders across different assets and styles |

These benefits explain why forex trading copying signals are widely adopted, especially in high-volume markets.

Choosing the Right Signal Provider

To make the most of signal copy trading, it’s critical to choose the right provider. Use this checklist:

- Proven trading history with transparent stats

- Strategy aligned with your risk profile

- Stable results over time, not one-off gains

- Platform-backed analytics (like Pocket Option’s provider metrics)

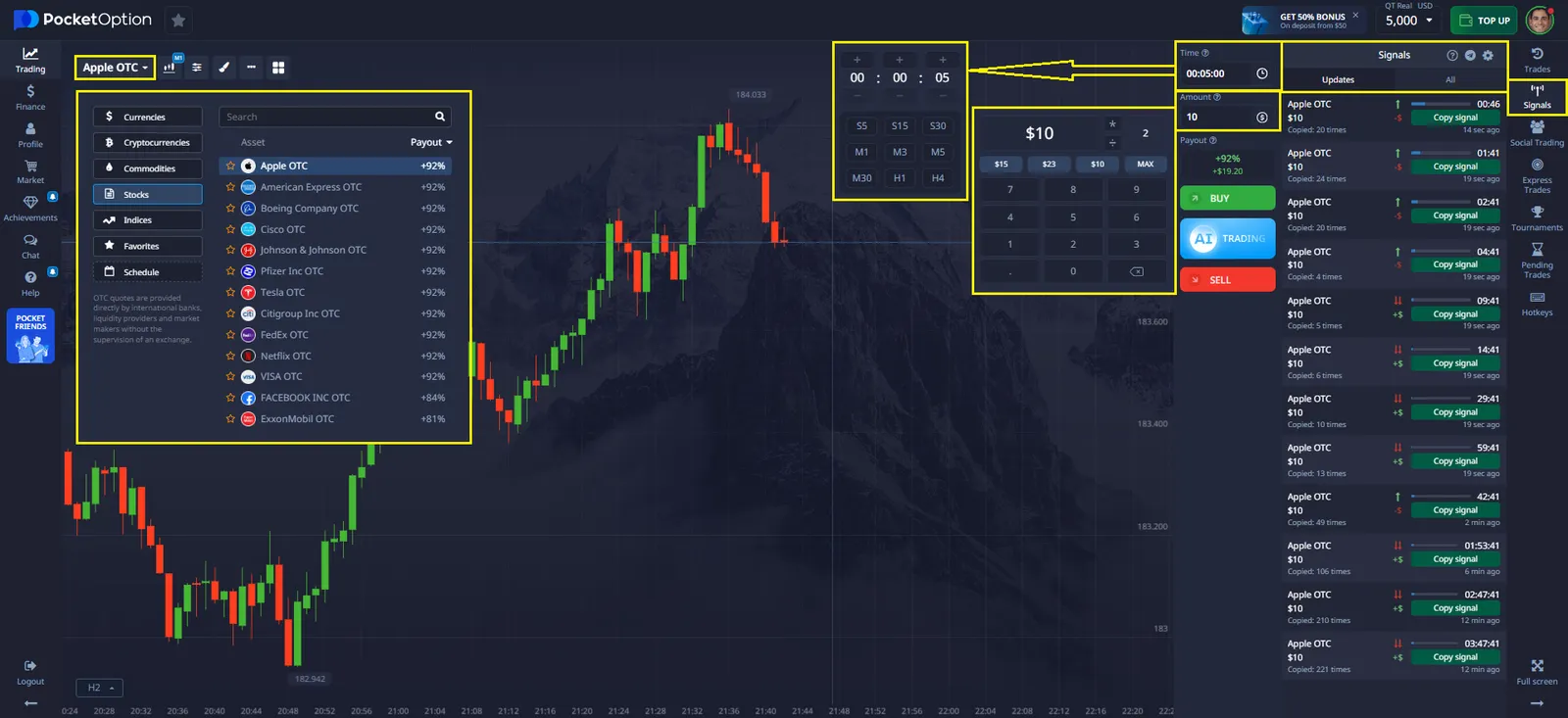

How to Copy Trade on Pocket Option: Step-by-Step

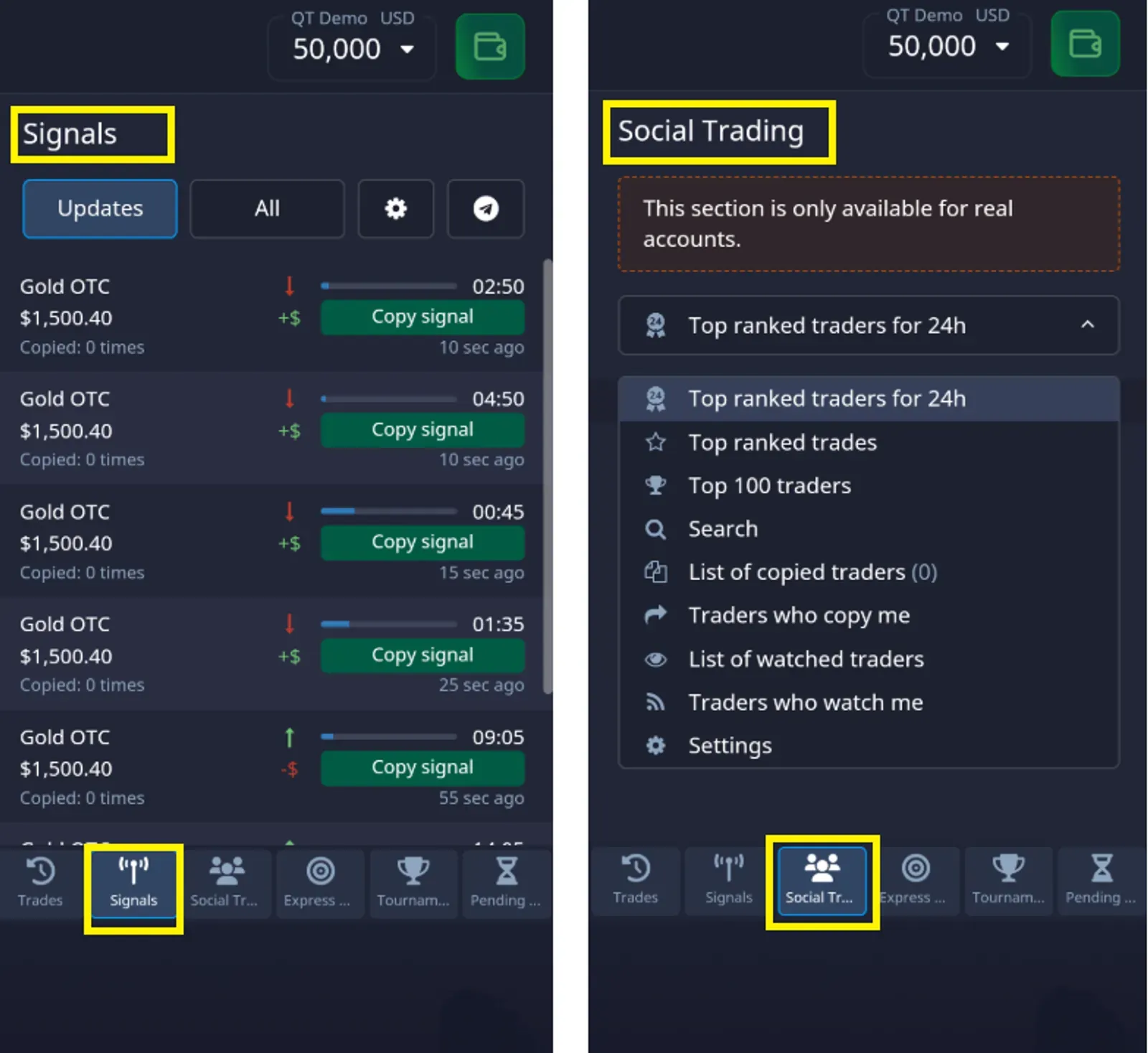

Pocket Option provides you with two useful features when it comes to trading signals:

🔹 Using In-Platform Signals

- Open the Signals section on the right side of your trading interface.

- Select a timeframe: S30, M1, M5, H1, H4, etc.

- View the available signals for assets (currencies, stocks, crypto, commodities).

- Arrows indicate the expected direction:

- One arrow → moderate signal

- Two arrows → strong signal

These insights help you assess whether an asset is expected to rise or fall within the selected timeframe.

🔹 Using Social Trading

- Go to the Social Trading section of your dashboard.

- Browse through top-performing traders with full stats.

- Choose one whose style and results match your goals.

- Click “Copy” or “Follow” — your trades will sync automatically.

This approach lets you tap into professional strategies while managing risk and staying in control.

Platform Comparison: Pocket Option vs. Other Services

| Feature | Pocket Option | Other Brokers |

|---|---|---|

| In-platform signal system | ✅ Yes | ⚠️ Often missing |

| Social Trading integration | ✅ Seamless | ⚠️ Limited options |

| Minimum deposit | 💲$5 | 💲$50–$200+ |

| Mobile-friendly interface | 📱 Optimized | ⚠️ Varies |

| Instant trade copying | ⚡ Within 10 sec | ⚠️ Delayed/manual |

Pocket Option stands out for offering fast, flexible, and accessible signal-based trading for beginners and experienced users alike.

Real User Experiences

“I started using Pocket Option’s copy trading after watching a few top traders. Within weeks, I noticed more consistency in my results — even while spending less time on analysis.” — Daniel M.

“Social Trading lets me learn from the best while managing risk on my terms. I can pause or adjust copying anytime.” — Leah R.

“Pocket Option’s signals are straightforward and accurate. The arrow-based interface gives me confidence in my next move.” — Hassan T.

These testimonials reflect how traders worldwide use Pocket Option’s tools to improve outcomes and build confidence.

Advanced Copy Trading Techniques

As you grow comfortable with signal copy trading, consider these strategies:

- Mix signal sources for uncorrelated ideas

- Use partial allocations to manage risk across providers

- Try reverse trading to test contrarian models

- Benchmark performance against manual trades

These techniques work well when tested over time and with proper data analysis.

Automated vs. Manual: What’s Better?

Some traders enjoy the control of copy and paste trading signals, while others prefer full automation. Here’s a direct comparison:

| Feature | Automated Copy Trading | Manual Copy and Paste |

|---|---|---|

| Speed of execution | Instant | User-dependent |

| Level of customization | Limited | High |

| Time required | Low | High |

| Flexibility | Moderate | High |

Choose the model that fits your trading habits and availability.

Conclusion

Copy trading signals have changed how people approach the markets. By tapping into expert trades and proven systems, you can save time, reduce emotional errors, and potentially boost performance. But remember: blindly copying isn’t enough — reviewing provider stats and setting clear limits is key.

Pocket Option’s signal features, from real-time in-platform alerts to advanced social trading tools, offer a comprehensive way to engage with the markets intelligently. Whether you’re exploring forex trading copying signals or prefer copy and paste trading signals manually, staying informed and strategic is what drives long-term growth. Discuss this and other topics in our community!

FAQ

What exactly is a copy trading signal?

A copy trading signal is an alert or notification that informs traders about specific market movements or trading opportunities. These signals are generated by experienced traders or algorithms and can be automatically replicated in the follower's trading account.

How does copy trading differ from traditional trading?

In traditional trading, individuals make their own trading decisions based on personal analysis. Copy trading allows traders to automatically replicate the trades of experienced professionals, potentially benefiting from their expertise without conducting extensive market analysis themselves.

Is copy trading suitable for beginners?

Yes, copy trading can be suitable for beginners as it allows them to learn from experienced traders while potentially earning returns. However, it's important for beginners to understand the risks involved and to start with small investments.

How do I choose a reliable signal provider?

When selecting a signal provider, consider factors such as their track record, risk profile, transparency, and consistency. Look for providers who offer detailed trade information and have a stable performance history.

Can I use copy trading signals on Pocket Option?

Yes, Pocket Option offers copy trading features that allow users to follow and replicate the trades of successful traders on their platform. They provide tools to help you select signal providers and manage your copy trading activities.